Operator to Investor 🎰

Welcome back to Consortium.

For the last two years, I have had a front row seat to innovation and have witnessed how individuals with deep conviction unite large teams under one vision. Being one of the first 100 employees at two early-stage startups in India has given me immense exposure to how companies evolve from seed to scale. What is unique to my journey however has been the opportunity to contribute to each firm’s trajectory in a deep and meaningful manner — something that has left me yearning for more. Although I could spend my life moving from company to company, helping each new team breathe life into an idea, I believe that would be a grave injustice to the limited time I have here — both to myself and to the ecosystem as a whole.

A natural solution to this challenge is entering the venture capital space as it provides me with the perfect platform to deploy my capital, labour, and time into helping ambitious teams build out their adventure. However, research is key in this endeavour and therefore, in this newsletter I would like to consolidate and outline my personal investment thesis — an understanding of why I would invest my resources into a company that is just starting out.

Happy reading!

Where, When, and Whom? 🤔

A common misconception in venture capital is that money is invested into companies and that investors are always on the lookout for the next big idea. Although there is some truth to this, most if not all investors are first on the lookout for trends and markets. The logic behind this behaviour lies in the nature of venture capital as an industry. Since this is a long-term game the potential success of a market or trend far outweighs the potential success of any company, and therefore, investors are far more likely to place their large bets on trends that are poised to grow and provide value as opposed to any one startup that shows promise.

An added layer of complexity to this is timing. What distinguishes a good investor from an excellent one is the ability to not only pick the best trends, but also enter the market at the right time. Entering too early into a market might lead to a huge payout in the future, but comes at the risk of great uncertainty1. Entering too late is as good as missing the last bus that will take you home.

Finally, along with selecting the right markets and getting the timing correct, venture capitalists bear the additional task of deciding how to enter the market they have chosen. Fundamentally, this boils down to picking the right team. While venture capitalists deal with trends, markets, and businesses, they are inherently in a relationship industry! As such, identifying and then backing a team that is capable of exploiting the returns of a market or trend through an exceptional product or service is arguably the most important aspect in venture capital.

Introducing Some Structure 🏗️

Evidently, a venture capitalist’s job is not easy. From research to investment, a host of decisions need to be made as large amounts of money are pumped into new ideas every single day. Thus arises the need for an investment thesis — a strategic guide that outlines the following:

Investment Focus: Defining specific sectors, stages, and/or geographies where investments will take place.

Market Analysis: Thorough market research on potential growth areas which includes emerging technologies or sectors that promise high returns.

Risk Assessment: Evaluating the possible risks associated with the investment strategy including market volatility, competition, and regulatory challenges.

Financial Projections: Analysis of potential returns based on historical data and market analysis.

Unique Value Proposition: Key differentiators from the rest of the investor pool.

In this structure, an investment thesis allows any fund or private investment vehicle to codify their approach to investing in the startup space. Not only is it beneficial to the investors themselves, but it is an excellent communication tool for limited partners (LPs)2 who are looking to align with an investor’s strategy.

Although the above framework to build an investment thesis is comprehensive, not every aspect of it might relate on an individual level. In this context, the framework requires some modification to account for individual socio-behavioural traits. As such, a version of this framework tailored to individual investors could potentially contain:

Investment Focus and Timeline: Industries that the investor is interested in alongside the short-term and long-term goals that influence the investor’s strategy.

Risk Appetite: Outlining whether the investor is aggressive or conservative, and and how they respond to macroeconomic factors such as market fluctuations and business cycles.

Research, Knowledge, and Network: Explaining how investors conduct their own due diligence on startups, what resources they have at their disposal, and what strategies they pursue when investing — value based, growth, or dividend seeking. Alongside this, an understanding of how deep or broad the investor’s network is in the context of their professional experience, educational background, and industry connections.

Diversification Approach: Understanding how the individual investor constructs their portfolio through diversification to mitigate risk — whether this is across different sectors or different companies within the same sector.

Personal Values and Ethics: Describing the investor’s priorities which align with their own ethical beliefs and/or social values that will influence their investing strategies.

Returns and Exits: An understanding of how the investor prioritises returns and their expectations around exits — whether they prefer mergers, acquisitions, or IPOs.

Noticeably, the key differences between an investment vehicle and an individual investor lie in their diversification approaches, networks, and risk appetites, as individual investors are far less likely to be incredibly diverse, have a large network and be risk seeking. Although this may seem as a disadvantage to any company looking to raise capital, if you are just starting out these traits may not necessarily be problematic as the need for a deep pocket might not be as pronounced relative to a more developed company. Furthermore, in the current economic climate, it is highly unlikely that ideas (however big) would raise exorbitant amounts of capital without anything to show for it at the outset.

Moreover, not every early stage, pre-revenue startup has the potential to raise capital from large institutional investors and therefore raising capital from smaller individual investors might make the most sense. Similarly, individual investors benefit from getting in on companies very early rather than later (eg. The Facebook), and are therefore attracted to bright ideas that have huge upside. Of course, this depends highly on the degree of risk aversion that each individual investor brings to the table.

Finally, the most important differentiator between an investment vehicle’s and an individual investor’s thesis is the incorporation of personal values and ethics, which can also prove beneficial as it allows for a greater sense of personalisation that early-stage startups may look for in terms of bringing on their first few investment partners.

Outlining My Personal Investment Thesis 🏛️

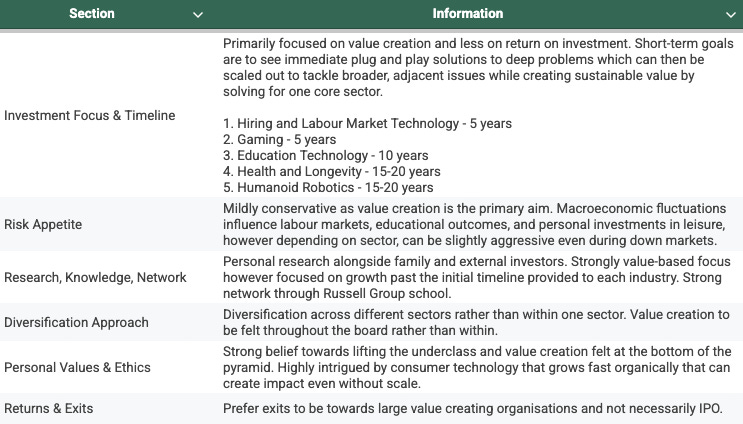

Applying the individual investor’s framework is fairly intuitive. Here is a table containing information on mine:

To break this down further:

Investment Focus: Being focused on value creation means that products and services must have the potential to create short and long-term socioeconomic impact. Short-term impact is determined by the ease with which solutions can fit in directly and create immediate value. Long-term impact is measured by how deeply these products and services integrate within the consumer’s lifecycle and thus pave the way for sustained value for a large number of people, businesses, and eventually society. Naturally, the way impact takes shape looks different for different industries. Here are some industries that I am focused on currently:

Hiring and Labour Market Technology: With the advent of multiple platforms such as Turbo Hire in India, Dover in the United States, and Sapia in Australia, the hiring space is ripe with innovative solutions spanning the entire recruitment value chain. Moreover, given that hiring is a two-sided marketplace, value can be unlocked both for companies as well as jobseekers.

For companies, entrepreneurs have the capability to build tools that help automate candidate search and recruitment, the candidate interview process, and even the writing of job descriptions and CV/resume shortlisting via state of the art applicant tracking systems. For jobseekers, tools that help speed up the application process, aid in interview performance, and create tailored CVs per application, would disrupt the current methods that people follow when participating in the organised labour market.

In this context, short-term value can be measured by the degree to which uptake of these products and services results in hiring efficiency. Long-term value can then be ascertained by not only how frequently these solutions are utilised, but also whether these solutions are then a fixed investment that optimises the hiring lifecycle for either the candidate or the recruiter. For understanding more on how value can be created in this space, I cover more of it in this previous post on Consortium Research.

Nonetheless, if you are a builder in this space, some metrics that indicate long-term impact are:Quality of hires measured via performance ratings and retention rates

Time to productivity ratios for new hires sourced through the platform

Roles posted by a client over time

Percentage of total workforce sourced through the platform

Salary progression for placed candidates

Job seeker and recruiter retention rates

Employer-to-candidate match quality over time

Ratio of active candidates to open positions

Gaming: As access to technology has rapidly grown alongside the rise in per capita income, more people than ever before have begun to invest in gaming as a form of leisure. Game creators have taken notice of this increased demand and have begun their own indie3 gaming studios such as Supergiant Games, Hazelight Studios, and InnerSloth.

From Visual Capitalist, we see that as technology has advanced, as has the development of category defining games and platforms. However, gaming is not just a form of entertainment, it has also become a focal point of socialisation in today’s digital space. Not only are console manufacturers and gaming studios making it easier for gamers to interact with one another, entire games like No Man’s Sky have been developed that are particularly focused around online player interaction and gameplay.

On the flip side, a nascent but fast-growing generation of players have now flooded the gaming market. Generation Alpha has unlocked new potential for the gaming industry as demands around customisation, interaction, and role playing within games have become the new standard.

From GWI’s Chart of the Week 2022 It is clear that gaming is here to stay and is poised to grow exponentially in the coming years. Since gaming is highly dependent on engagement, retention, and stickiness, (especially when it comes to younger audiences), any builder who is thinking of creating games for the long term would benefit from tracking:

Player engagement measured through time spent on the game/platform

Feature uptake and interaction rates

Player retention rates particularly on Day(s) 1, 7, 14, 30, and 90

Daily (DAU), weekly (WAU), and monthly active users (MAU) especially the “activated” user cohort

Player stickiness measured through DAU/MAU and WAU/MAU ratios

In the strictest sense, gaming does not provide bottom-of-the-pyramid socioeconomic impact, however, expanding my investment framework allows for impact to be measured differently in that, connecting and bringing people together, creating healthy environments for safe digital interaction and providing new avenues and methods of learning for incoming generations can all come under the ambit of creating impact. Moreover, gaming has the potential to be educational, therapeutic, and in some cases even rehabilitative depending on the audience being catered to.Educational Technology: Globally, the quality of education has been a fundamental challenge. The United Nations Sustainable Development Goals even outlines quality of education in Goal #4 — “Ensure inclusive and equitable quality education and promote lifelong learning opportunities for all.” As such, every country faces an upward battle in not only improving the quality of education but also ensuring that all citizens have access to the same levels of education. Over the last decade, with the ushering in of several rapid technological advances, bright and ambitious builders have taken up the task to provide real, tangible value to students across the entire educational lifecycle.

For example, Jungle AI allows students to quickly upload their notes in the form of powerpoint presentations, PDFs or even YouTube videos and then instantly receive multiple questions, flash cards, and other resources in order to study better. Here is a video of me using the platform to study for my Investment and Portfolio Management class:On the other hand, Brisk Teaching benefits teachers across a variety of functions such as targeted student feedback, quiz generation, administrative tasks, writing inspection, and even instructional material creation across a myriad of subjects. Tools like Brisk take on the education problem by enhancing the level of teaching rather than focusing primarily on the student, thereby treating institutional quality as an independent variable that improves a student’s educational outcome.

Although private companies have taken advantage of the access to venture capital and have built scalable solutions, in the effort to improve education, entrepreneurs can also leverage other members of this ecosystem, particularly, the government. For example in India, the National Educational Alliance for Technology or NEAT was launched in 2019 by the All India Centre for Technical Education (AICTE).

The primary aim of NEAT was to bring edtech solutions to the many students who do not have access to good quality and affordable learning options online. Even though most if not all edtech firms are for-profit, those that signed on to NEAT have to provide their solutions for free to a fraction of the students who use the product.In the latest version of NEAT, the AICTE has cut down the number of edtech firms from 58 to 22, and have prioritised “quality over quantity”. Additionally, those edtech products that are “overpriced” have been removed and therefore, NEAT 3.0 now has 40 edtech products on offering as opposed to the previous cohort’s 100. From a technological standpoint, there is now a strong focus on edtech firms integrating AI, ML, robotics, drones, gamification, and 5G technology into their products and services.

Some notable firms that have signed on are:

Ansys Software: Allows students and teachers to incorporate engineering simulation skills into the curriculum through materials such as homework outside of the classroom, capstone projects, student competitions, and simulation software to support the learning and teaching of engineering, science, and design.

Dheya Career Mentors: Specialised career guidance programs where students can gain clarity about their career paths, learn how to navigate difficulties that they may face in their professional space, and get the tools and resources needed to make effective career related plans and decisions.

Despite this support from the Indian government, there are challenges that surround building in the edtech space. From marketing and selling to the right consumers, to making sure that profitability and enhanced learning outcomes stay balanced, entrepreneurs in this industry have a steep hill ahead of them. Regardless of these difficulties, there is a large opportunity ahead as education will always be a pressing need and with greater access to technology, things only get easier. If you are building in this space, metrics to track are:Daily, Weekly, and Monthly Active Users

Student retention rates and stickiness ratios particularly during testing seasons

Customer Acquisition Cost — something that has proved to be problematic for most K-12 edtech builders

Average Revenue Per User (ARPU) — important for when monetisation is introduced

Content Engagement Time and Success — to track how different content features such as videos, reading material, and other learning tools affect student educational outcome

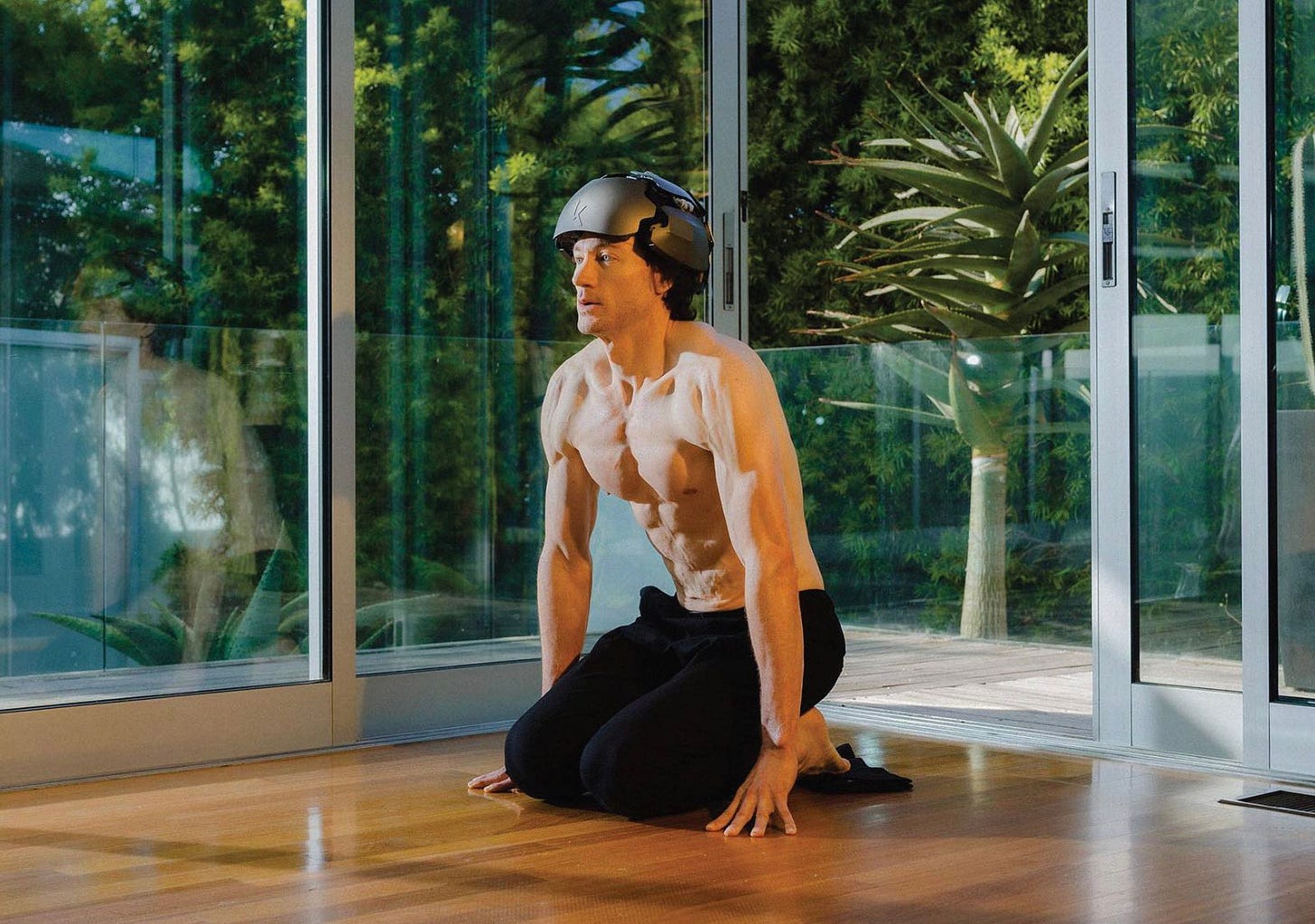

Health and Longevity: By now, most if not all have heard about Bryan Johnson. Most infamously known for Project Blueprint, Johnson and his “Don’t Die” community are on a mission to defeat death and build prosperity. In an effort to do so, Johnson has invested millions of dollars into developing a protocol that allows him to track multiple biomarkers that help him “slow down” his process of aging. The biomarkers he tracks are:

Speed of aging: Rate at which biological aging processes occur, measured through epigenetic markers4

Muscle mass function: Strength, volume, and performance of skeletal muscle tissue

Fat mass: Amount and distribution of adipose tissue

Inflammation: Systemic inflammatory markers like CRP5 and IL-66

Cardiovascular: Heart and blood vessel health metrics

Bone mass: Density and strength of the skeletal system

Sleep: Quality, duration, and efficiency of sleep patterns

Combined clinical markers: Aggregated blood work and vital signs

Nighttime erections: Indicator of hormonal and vascular health in males

Bryan Johnson from Colin Keeley Tracking these biomarkers is just one part of a much larger project that involves controlling sleep, diet, exercise, family and friendships, and actively avoiding fast food, junk food, smoking, vaping, excessive alcohol, and social media — in essence, anything addictive. The end goal for Project Blueprint is to allow for scalability — such that most everyone can achieve what Johnson has been able to despite budget. For now, Blueprint provides testing kits, supplements, and biomarker tests for anybody who wants to hop on to this journey, but this is not made for the average human being’s bank account, let alone the average American’s.

Blueprint also faces the additional challenge of adoption. Although there are some who can afford the Blueprint Protocol, not many would be genuinely willing to go the whole nine yards. For few, it may even fundamentally disagree with their lifestyle. The barriers to entry are far too high. Despite the benefits that Johnson touts across a variety of social media platforms, the apparent discipline, budget, time, and effort needed to fully dedicate oneself to the Blueprint might be something not many can truly afford.

Although Blueprint faces obstacles, does not mean that it holds no validity, and certainly is not a commentary on the opportunity that the longevity space holds for entrepreneurs. Other companies building in this area tackle human health from entirely different angles. Some examples are:Altos Labs: Founded in 2021 and based in California, Altos Labs focuses on cellular rejuvenation. By utilising the foundational science put forth by Shinya Yamanaka, Altos Labs found that cells can be “partially” reprogrammed to a state that is more resilient to stressors while maintaining their identity and the enhanced functions seen in young cells.

Unity Biotechnology: Unity works with a mission that is geared towards developing therapeutics that aim to restore diseased tissue to a healthier state. Currently, their goal is primarily on developing medicines that leverage the pathways of aging biology with a focus on retinal disease.

LyGenesis: LyGenesis tackles the longevity problem by going after life-threatening diseases such as Type 1 diabetes and end-stage liver and renal disease by using cell therapy. By transforming a patient’s lymph nodes into bioreactors capable of growing their own ectopic organs7, LyGenesis breaks the current one-to-one paradigm by enabling one organ donor to treat dozens of patients.

Entrepreneurs building in this space should look out for biomarker improvements, epigenetic age reduction, lifetime value, treatment adherence rates, clinical trial results, regulatory approvals, patient satisfaction, and treatment completion rates as signs of success in their ventures.Humanoid Robotics: Have you ever seen Will Smith’s 2004 I, Robot? In the movie, a transluscent humanoid robot was conceived of as a public service helper, built to aid humanity in tasks such as industrial work, personal assistance, and household help. Although the idea of a humanoid robot helping its human “masters” has been well captured throughout science fiction, today, with the advent of artificial intelligence and access to new industrial technology, this has now become a reality.

Many firms are making strides in this space. However, one company stands out to me personally — Figure. Figure was born out of the vision of Brett Adcock (founder of Archer Aviation and Vettery) to create the world’s first commercially viable autonomous bipedal robot. Beyond automation, Figure hopes to enhance human productivity by building robots that are capable of human reasoning and adaptability. Its flagship product is Figure 01 — a 5 foot 8 inches tall, 130 pounds humanoid robot that is designed for environments where human labour is short.

Some of Figure 01’s main capabilities are walking, lifting heavy objects, and even making coffee. Through advanced sensors, cameras, LiDAR8, and a sophisticated system of joints and actuators, Figure 01 emulates human dexterity and movement seamlessly. As of August 2024, Figure 01 is superseded by Figure 02, featuring more streamlined design, enhanced capabilities, and improved computational power. Additionally, Figure has partnered with Open AI for developing specialised AI models that allow the Figure 02 to engage in conversational interactions.

From Motor Authority Others such as Agility Robotics and their robot Digit, Boston Dynamics and their robot Atlas, and Softbank Robotics with their emotion-reading robot Pepper are some of the many companies that are right alongside Figure, building at the frontier of humanoid robotics. The reasoning for this could be two fold:

The applications of humanoid robots are massive especially in developing countries where life-threatening jobs fuel a good fraction of the informal economies. For example, in agriculture, pesticide application and harvesting, or in manufacturing, managing inventory or performing inspections, humanoid robots have a wide range of applications. As such,

The humanoid robotics industry is predicted to grow at a ~49% CAGR and is expected to balloon to ~USD $45B in 2031

Although the opportunity to build in this space both in terms of product application and market size is large, this industry comes with its own unique challenges:Building complex mechanical control systems that can match human dexterity and balance especially for finer motor movements

Large computational requirements that are needed for real-time processing of sensor data and movement control

Cost of development and manufacturing particularly for specialised components

Achieving safe human-robot interaction (re: I, Robot) including natural language processing (NLP), vision systems, and appropriate behavioural responses that make humans comfortable

Scaling manufacturing while maintaining quality control

Market uncertainty and defining clear use cases that justify the incredibly high cost of building humanoid robots

Regulatory compliance and safety certifications

Testing and validation complexity

Despite these challenges, ambitious founders who are thinking of building or are building in this industry should focus on task completion accuracy in human environments, movement precision and repeatability, mean time between failures, power efficiency, and component failure rate amongst other key metrics to determine success of their robots.

Risk Appetite: Now that the key investment themes of the thesis have been fleshed out, it is important to understand how much value can be created. Since investing requires the deployment of significant capital, labour, and time, how much value can be created is correlated with the amount of risk that one carries. As outlined above, my personal risk appetite is mildly conservative as I am ambitious but also careful since the time horizon for value creation is vast and visions, missions, and goals can get lost along the way. As a significant fraction of the problems I am persistent on solving are very closely related with macroeconomic health, my conservativeness lies in the skepticism of whether those who are on the path to unlock value will truly be able to do so when things turn for the worse.

However, one sector I am confident in supporting during bearish weather is the health and longevity industry primarily due to its evergreen necessity and utility to humanity. Moreover, most crises, economic or otherwise tend to shock purchasing power and as such, supporting diagnostic, pharmaceutical, and supply chain solutions in this space would lead to easier access to these services in times of need, thus creating time-invariant socioeconomic value.Research, Knowledge, Network: Any investor’s risk appetite and investment value is a direct function of the amount of information they have on their hands. As such, the research they conduct, the knowledge they gather, and the network they build is vital to making sure that there is as little information asymmetry as possible when making large bets on exciting ideas. Institutional investors have an outsized advantage in this case given their size and scale and the subsequent resources that come along with these characteristics.

Relatively, individual investors are disadvantaged, however when compared to other individuals, some might have access to more information just as some might have access to more capital and might be less risk averse. What gives an individual investor these advantages? A starting point could be their educational and professional background. On one extreme end we see investors such as Peter Theil who have studied at Stanford University and have spent a majority of their professional life in the Bay Area (arguably the Mecca of technological innovation) while founding and supporting path breaking companies such as PayPal, Space X, Palantir, and Airbnb. This gives him the advantage of meaningful experience which in turn translates to a repository of research, knowledge and as such, information. Possessing vast information allows him to then make concentrated, well thought-out investments that would then potentially evolve into valuable organisations that shape humanity. A virtuous cycle is created.

On the other end would be individuals such as myself, who have had experience only within the Indian startup ecosystem and have a limited amount of capital and network relative to other successful professionals and/or startup founders in India. As a result, I am far more risk averse and therefore willing to only make sure investments — an oxymoron in venture capital. Although my network is bolstered by my educational experience at a Russell Group school, my lack of experience in making investments and my inability to write large cheques might turn off capital intensive ideas, more serious, fleshed out business plans, and founders who require specialised support in traversing the 0-1 journey.

However, everyone must start somewhere, and as such smaller businesses and simpler ideas might be the right place to begin my personal investing journey. As my capital is fairly limited it is my experience and background that would help byte sized ideas grow. Therefore, smaller ideas which require a modest amount of capital but are willing to bring me in on the ground floor are exciting. One example is a friend’s e-commerce store — Dorayaki! Dorayaki brings value to Indian artisans by allowing them to scale their products and business through a zero-commission digital platform.Diversification Approach: Across venture capital, different investors diversify their investments differently. Some such as Owl Ventures invest primarily in educational technology companies such as Leap Finance, Quizlet, Masterclass, Apna, ClassPlus and Code Academy. The core belief underlying Owl Ventures’ investment strategy is that education is undergoing a digital revolution across the globe and that this revolution will create valuable companies at the intersection of technology and learning.

Alternatively, Founder’s Fund has a more comprehensive investment manifesto which targets visionary entrepreneurs tackling difficult scientific and engineering problems. Additionally, unlike Owl Ventures which only invests in educational technology companies, Founder’s Fund invests in Aerospace, Biotechnology, Advanced Machines, Energy, and Deep Internet Technology. Moreover, from an economics standpoint, their investment criteria includes firms that are:Not currently popular as there would be less price competition

Difficult to assess as this means there is ample white space in the market

Led by mission-driven founders

Faced with manageable but real technological risk

Targeting enormous markets

In essence, the core belief of the fund is to back transformational technologies as they are truly the path to superior returns and positive societal impact. Similar to Founder’s Fund, my diversification approach spans different sectors as seen above, however as I mentioned earlier, one sector I am truly willing to go deep within is the healthcare space. Personally, I believe that value can be created across the board rather than just within one sector, however circumstances such as global macroeconomic climate, regional socioeconomic differences, and sociocultural factors can affect the degree to which diversification is practiced.Personal Values & Ethics: As my professional and educational background have been strongly impact oriented, the personal values that drive my investment thesis follow in a similar vein. Lifting the underclass and creating value for underserved communities informs a majority of the choices I have made in terms of the industries I wish to back. Furthermore, I augment this with my passion for consumer technology and my belief in its transformative power in impacting the underprivileged. Finally, sustainable organic growth is key as it cuts the cost of customer acquisition down to almost nil therefore allowing businesses to prioritise value creation rather than hyper-focusing on profitability.

Something that would personally stand out to me would be firms building products and services by formalising the informal economy. In other words, when companies integrate informal workers into their value chain, they unlock significant untapped potential. This creates a powerful growth cycle wherein:For example, many artificial intelligence (AI) models require vast amounts of training data that needs human labelling and verification. By creating structured employment programs that bring in informal workers into roles such as data labelling, annotation, and validation, tech firms can provide stable digital employment, improve AI model accuracy, enable workers to gain valuable skills and steady income, and create a multiplier effect that increases purchasing power and grows the economy. Although problems regarding this model have been documented extensively, safe and ethical work can still be created within this paradigm as technology advances.

Returns & Exits: Since value creation is the central tenet that drives this investment thesis, if an exit is expected, portfolio companies merging into larger organisations would be ideal as opposed to an initial public offering. Mission-driven organisations that align strongly with the portfolio company on strategy, vision, and goals should go ahead with a merger which would then create outsized returns for:

The communities that have already benefitted from the value that the portfolio company has built as the parent company can now expand further

The investors of the portfolio company therefore contributing to the investment pool for future value creators

To summarise, exits in the manner of mergers and acquisitions thus create a two-fold benefit and should not prioritise one over the other. Since exits would be strategically placed in the hands of larger, more impactful organisations, the already existing value would only grow and current investors would benefit from returns as further investments can then be facilitated into other value-driven companies. Alternatively, if an IPO were to take place, external, public investors should include informal workers who have already been part of the company’s value chain, thus creating financial gains for a number of individuals and families.

Building The Future 🔮

Progress and value creation is a Herculean task, even for those with war chests at their disposal. The key reason for this is time. Each solution that ambitious entrepreneurs work on building everyday takes time. Bringing these solutions to the market takes time. Scaling them, making them more accessible by making them more affordable and building more use cases, takes time. Creating meaningful value, takes time. However, the more that we build and the more that we support those that build, the less time it takes to create the future.

I urge all my readers to think deeply about what value creation means to them. What does a future for yourself in 20 years look like? What does a future for your children look like? What kind of industries, companies, technology do you envision around you? Introspect on these questions, write down your answers, and think about:

Whether or not you think contributing to this future is worth your capital, labour, and time

If these answers really matter to you, what can you as an individual do about it?

Are you going to build a community of friends and family who are willing to support high-school entrepreneurs creating value for students? Or are you going to set up a fund to help the next generation of scientists cure life threatening diseases? Or are you going to a builder yourself and change the face of education as we know it?

The future is in your hands.

If you have reached this far, thank you very much for reading this issue from Consortium. I have loved every bit of research, writing, reading, scrapping, and re-writing. I hope you have enjoyed this as much as I have, and have hopefully learnt something new along the way.

See you soon!

MVP

Additionally, venture capitalists face the risk of a longer investment time horizon, higher market development costs, regulatory uncertainty, and limited exit opportunities amongst other challenges.

A limited partner (LP) is an investor in a limited partnership who contributes capital but does not participate in the day-to-day management of the business.

Indie noun [ C ] uk /ˈɪn.di/ us /ˈɪn.di/ — A small company, especially a music, film, or television company, or a small shop or other business that is not owned by a larger company.

Epigenetic markers are chemical modifications to the DNA and associated proteins that affect gene expression without changing the DNA sequence itself. For example, excess DNA methylation (the addition of methyl groups to DNA) or excess histone modification (where histone proteins around which DNA wraps), can lead to silenced gene expression, thereby not allowing cells to create necessary proteins.

CRP (C-Reactive Protein): A protein made by the liver that increases when there's inflammation in the body.

IL-6 (Interleukin-6): A protein involved in immune responses and inflammation, produced by various cells including fat tissue and immune cells.

Essentially, a novel approach to organ generation where lymph nodes are used as natural “growth chambers” for new organs. Lymph nodes are repurposed to act as bioreactors - controlled environments where tissue can grow. The term "ectopic" means growing tissue in an abnormal location.

LiDAR (Light Detection and Ranging) is a remote sensing technology that uses laser pulses to measure distances and create detailed 3D maps of environments. It works by emitting laser beams and measuring the time taken for the light to return after hitting objects, enabling accurate distance calculations and detailed surface mapping.